Any aspiring entrepreneur today can start a business just by creating a page on social media or using an e-commerce platform. Due to the convenience of digital platforms, the number of registered online companies in the Philippines increased from 1,700 in January to March 2020 to 75,000 by the end of the year.

While starting online helps entrepreneurs save on costs, one thing remains certain: small- and medium-sized enterprises (SMEs) still need adequate funding to scale every aspect of their business—inventory, logistics, marketing, customer service, and many more.

Banks are equipped to grant loans to SMEs, but stringent requirements and non-flexible terms make it difficult for budding entrepreneurs to secure funding. In fact, 77% of SMEs in the Philippines have been unable to secure any or sufficient funding on at least one or more occasions over the last five years.

This is where online loans come into play. Online lending companies typically help SMEs secure funding through digital channels. Compared to conventional bank loans, online loans are more accessible as they have fewer requirements and faster approval. They’re ideal for SMEs needing emergency funds or having difficulty getting approval for bank loans.

If you need more funding to scale your business, this infographic can help you learn about online loans in the Philippines and how to apply for them.

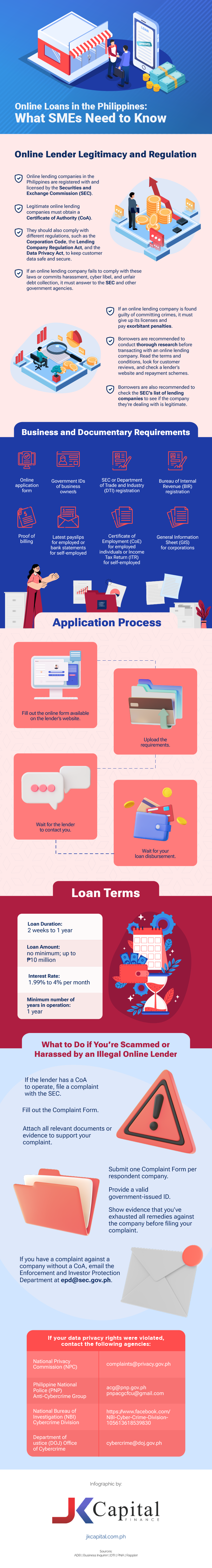

Online Lender Legitimacy and Regulation

Online lending companies in the Philippines must be registered with and licensed by the Securities and Exchange Commission (SEC) instead of the Bangko Sentral ng Pilipinas (BSP).

They’re required to obtain a Certificate of Authority (CoA) before they can offer loans. To get a CoA, lenders should fulfill the requirements in forming an ordinary stock corporation and have a minimum paid-up capital of ₱1 million.

Once registered with the SEC, online lending companies should comply with different regulations, such as the Corporation Code, the Lending Company Regulation Act, and the Data Privacy Act, to keep customer data safe and secure.

If an online lending company fails to comply with these laws or commits harassment, cyber libel, and unfair debt collection, the SEC and other government agencies will investigate the claim. It’s required to cooperate during the investigation. The online lending company would have to give up its licenses and pay exorbitant penalties if found guilty.

Even if an online lending company is registered with the SEC, you should still conduct thorough research before transacting with one. You can read the terms and conditions, look for customer reviews, and check its website and repayment schemes. If a company makes an offer that’s too good to be true, that’s usually a sign that it’s not as legitimate as you think.

You can also check this list of SEC-registered online lending companies to see if the lender you’re dealing with is legitimate.

Business and Documentary Requirements

Online loan requirements vary per lender, but below are some that they typically ask for:

- Online application form

- Government IDs of business owner/s

- Securities and Exchange Commission (SEC) or Department of Trade and Industry (DTI) registration

- Bureau of Internal Revenue (BIR) registration

- Proof of billing

- Latest payslips for employed individuals or bank statements for self-employed individuals

- Certificate of Employment (CoE) for employed individuals or Income Tax Return (ITR) for self-employed individuals

- General Information Sheet (GIS) for corporations

For more specific requirements, you can check the website of the online lending company you plan to borrow from or directly contact them via phone or email. Some online lenders require borrowers to prove their age, place of residence, and properties such as cars and tech devices.

Since these companies are available online, you can submit soft copies of your documents anytime via their app or website. This helps SME owners save time and costs from visiting in person when applying for loans.

Application Process

Applying for an online loan is usually fast and easy. Online lending companies can process and approve a loan in three to seven business days, which is faster compared to banks that take two to three months. Most online lenders also have relationship managers and customer support teams to assist you throughout the process.

While the application process is different per lender, here are the basic steps that you need to accomplish:

- Fill out the online form available on the lender’s website.

- Upload the requirements.

- Wait for the lender to contact you.

- Wait for your loan disbursement.

Online Loan Terms

Before applying for an online, you need to consider some factors and align them with your business needs. Some of these include:

1. Loan duration

Online loans are ideal for SMEs that need quick or short-term funding. Online lenders allow SMEs to repay their loans within two weeks or a year. Some also offer biweekly or monthly repayment schemes where the borrower pays both interest and principal.

SMEs that need short-term funding can also save on costs with online loans. Banks typically charge extra for early repayment or loan terminations to compensate for the interest they would’ve collected from you until your loan matures. These fees are typically 4–8% of your current outstanding balance.

2. Loan amount

Online lenders have different caps for their loans, but most offer somewhere between ₱50,000 and ₱10 million. This is in stark contrast to banks, which offer around ₱1 million to ₱20 million in loan amounts.

The loan amount of online lenders may be small, but it’s perfect for SMEs that need quick funding and can repay within a few weeks or months.

3. Interest rates and processing fees

When it comes to interest and processing fees, banks are more modest because they have access to cheaper sources of funds, such as customer deposits. They can also maintain risks at lower levels. Their monthly interest rates are around 0.50% to 1.5%, with processing fees at 0.75% of the loan amount.

Meanwhile, online lending companies offer monthly interest rates of around 1.99% to 4% and charge processing fees of 1.99% of the loan amount. Some online lending companies may charge other fees, which may not be published on their website or communicated to borrowers at the onset.

When getting an online loan, ask your relationship manager or customer support representative about these fees to manage your financial expectations efficiently.

4. Minimum number of years in operation

Banks often grant loans to businesses that have been in operation for at least two to three years, with one year of profitable operations. Meanwhile, many online lending companies grant loans to those still in their first year of operations. This is ideal for SMEs that have seen growth in a short time and need funding to continue doing so.

What to Do if You’re Scammed or Harassed by an Illegal Online Lender

Online lending in the Philippines can be a bit of a minefield, as some illegal lenders are becoming smarter by the day, posing as legitimate companies. If you think you’re being scammed or harassed by an online lender, follow the steps below:

- If the lender has a CoA to operate, file a complaint with the SEC.

- Fill out the Complaint Form.

- Attach all relevant documents or evidence to support your complaint.

- Submit one Complaint Form per respondent company.

- Provide a valid government-issued ID.

- Show evidence that you’ve exhausted all remedies against the company before filing your complaint.

- If you have a complaint against a company without a CoA, you can email the Enforcement and Investor Protection Department at epd@sec.gov.ph.

- If your data privacy rights were violated, contact the following agencies:

- National Privacy Commission (NPC) – complaints@privacy.gov.ph

- Philippine National Police (PNP) Anti-Cybercrime Group – acg@pnp.gov.ph and pnpacgcfcu@gmail.com)

- National Bureau of Investigation (NBI) Cybercrime Division – https://www.facebook.com/NBI-Cyber-Crime-Division-105613618539830

- Department of Justice (DOJ) Office of Cybercrime – cybercrime@doj.gov.ph

Scale Your Business with an Online Loan Today

Online loans are easy solutions for SMEs that need quick, short-term funding. Not only will online loans help SMEs scale their business, but loans will also help build their credit score and improve their financial standing in the long run.

Naturally, this will only be possible if you work with a legitimate online lending company. Before getting an online loan, conduct your research so that you won’t fall victim to scammers.

If you’re ready to secure an online loan, you can borrow from a reliable online lending company in the Philippines like JK Capital. We offer instant financial solutions to SMEs planning to go beyond their horizons. Check out our services to learn about our requirements and application process, or fill out our contact form for inquiries.