Two years after the COVID-19 pandemic, a clear takeaway is that the Philippines was not, in any way, spared by the global crisis. COVID-19 crippled the Philippine economy. Thousands of businesses closed—with micro, small and medium enterprises (MSMEs) being hit the hardest.

It’s really an unfortunate scenario, considering that MSMEs have been significantly contributing to the Philippine economy in recent years by increasing employment opportunities for Filipinos, boosting trade activities across industries, and so on. That is until the pandemic happened.

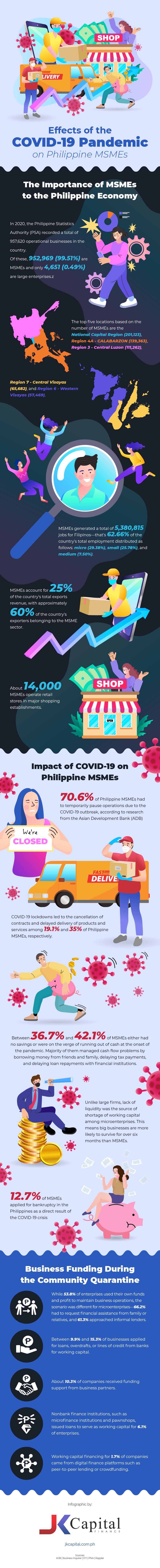

As you’ll see in this infographic, there’s no shortage of statistical data showing how COVID-19 affected small businesses in the Philippines.

Effects of the COVID-19 Pandemic on Philippine MSMEs

As we continue to live with the COVID-19 pandemic, it’s vital to take a step back to see where we have been in the past two years and where we’re headed. For socioeconomic think tanks and policymakers, the question is, how did the pandemic affect the Philippine economy?

The Importance of MSMEs to the Philippine Economy

One of the top players in the country’s economic growth is the MSME sector. Entrepreneurs in this category may be all too familiar to you—from the grocery store owner in your neighborhood to online sellers and tech start-ups.

MSMEs also refer to business organizations with no more than 200 employees and whose asset size does not exceed P100 million. They encompass a wide range of industries, including wholesale and retail trade, repair of motor vehicles and motorcycles, accommodation and food services, manufacturing, service-oriented activities, and finances and insurance.

MSMEs have valuable contributions to business economics, as data and statistics reveal.

- The Philippines is home to 957,620 businesses. Of these, 952,969 (99.51%) are MSMEs—making them the main drivers of the local economy—compared with large enterprises, which only total 4,651 (0.49%).

- MSMEs have established businesses in key locations around the country, including the National Capital Region (201,123), Region 4A – CALABARZON (139,363), Region 3 – Central Luzon (111,262), Region 7 – Central Visayas (65,682), and Region 6 – Western Visayas (57,469).

- Thanks to MSMEs, there are approximately 5.4 million jobs available for Filipinos. This figure represents 62.66% of the country’s total employment rate.

- MSMEs are also active in export trade. With approximately 60% of the country’s exporters belonging to the sector, 25% of the country’s total exports revenue comes from MSMEs.

- There are about 14,000 micro, small, and medium retail stores in big shopping centers.

Impact of COVID-19 on Philippine MSMEs

Given their limited size and resources, it wasn’t surprising that MSMEs would face numerous challenges in their business operations during the pandemic. Factors like transport restrictions, stay-at-home orders, transition to remote work setups, and the like made it difficult for MSMEs to conduct business as usual.

From paying staff wages, social security benefits, and loans to collecting payments from customers, MSMEs found themselves in serious financial distress. As such, they could not maintain a good cash flow in their day-to-day business activities.

- The Asian Development Bank released a paper in September 2020, reporting that 70.6% of MSMEs had to temporarily pause operations as a result of large-scale lockdowns in the Philippines.

- COVID-19 quarantine measures also forced 19.1% of MSMEs to cancel their business contracts. Meanwhile, 35% of those who managed to continue operations faced issues like delays in product or service delivery to customers that would only worsen their financial health.

- Between 36.7% and 42.1% of MSMEs either had no savings or were on the verge of running out of cash at the onset of the pandemic. Micro and small firms had to borrow money from people they knew—family, relatives, or friends—while medium-sized firms dipped into their own funds or used their profits to stay afloat.

- Big businesses have liquid assets, making them more likely to survive a pandemic for over six (6) months than MSMEs.

- Perhaps the worst effect of the COVID-19 pandemic is causing 12.7% of MSMEs to permanently shut down after being bankrupt.

Business Funding During the Community Quarantine

MSMEs who needed financial support to cope with COVID-19’s impact on their business explored different funding options. This strategy has allowed them to carry out their business recovery plans slowly.

- The Department of Trade and Industry (DTI) has a zero-interest, zero-collateral loan called COVID-19 Assistance to Restart Enterprises (CARES) program. As of December 2021, about 137,168 business owners were able to borrow a total of P6.13 billion from the program.

- While 53.8% of enterprises used their own funds and profit to maintain business operations, the scenario was different for microenterprises—66.2% had to request financial assistance from family or relatives, and 61.3% approached informal lenders. Business partners also helped 10.3% of companies with their funding needs.

- Bank loans and lines of credit became alternative sources for 9.9% to 15.3% of businesses, providing them with the working capital they needed. In cases where small and medium enterprises had already exceeded their credit limit, they could make arrangements with the lender to receive additional funding through business overdrafts.

- Non-traditional financial institutions have greatly helped MSMEs, too. At the height of the pandemic, microfinance institutions and pawnshops allowed some 6.1% of enterprises to take out small business loans to support their attempts to bounce back from the crisis.

- Digital finance platforms such as peer-to-peer lending or crowdfunding were also instrumental in offering business financing for 1.7% of companies.

Philippine MSMEs: On the Road to Recovery

COVID-19 has taught us valuable life lessons, including managing finances amid a crisis—in the context of the Philippine economy, that means getting MSMEs involved in reviving the country’s favorable business conditions.

Thus, restarting the economy requires the recovery of our micro, small, and medium enterprises. Now that the pandemic is slowing down, it’s the perfect time for MSMEs to reopen their doors and begin their journey toward business recovery.

Fortunately, small business loans are accessible now more than ever. JK Capital offers zero-collateral, low-interest business loans to boost your finances and help your company get back on track. Inquire about our easy business loan!