Small Business Funding: Ultimate Guide for En

Every entrepreneur’s journey starts with finding ways...

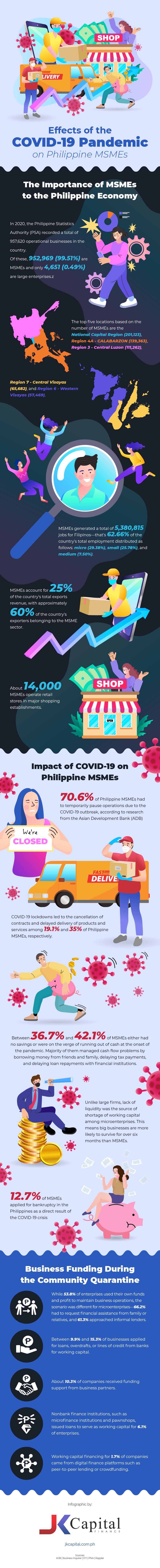

Two years after the COVID-19 pandemic, a clear takeaway is that the Philippines was not, in any way, spared by the global crisis. COVID-19 crippled the Philippine economy. Thousands of businesses closed—with micro, small and medium enterprises (MSMEs) being hit the hardest.

It’s really an unfortunate scenario, considering that MSMEs have been significantly contributing to the Philippine economy in recent years by increasing employment opportunities for Filipinos, boosting trade activities across industries, and so on. That is until the pandemic happened.

As you’ll see in this infographic, there’s no shortage of statistical data showing how COVID-19 affected small businesses in the Philippines.

As we continue to live with the COVID-19 pandemic, it’s vital to take a step back to see where we have been in the past two years and where we’re headed. For socioeconomic think tanks and policymakers, the question is, how did the pandemic affect the Philippine economy?

One of the top players in the country’s economic growth is the MSME sector. Entrepreneurs in this category may be all too familiar to you—from the grocery store owner in your neighborhood to online sellers and tech start-ups.

MSMEs also refer to business organizations with no more than 200 employees and whose asset size does not exceed P100 million. They encompass a wide range of industries, including wholesale and retail trade, repair of motor vehicles and motorcycles, accommodation and food services, manufacturing, service-oriented activities, and finances and insurance.

MSMEs have valuable contributions to business economics, as data and statistics reveal.

Given their limited size and resources, it wasn’t surprising that MSMEs would face numerous challenges in their business operations during the pandemic. Factors like transport restrictions, stay-at-home orders, transition to remote work setups, and the like made it difficult for MSMEs to conduct business as usual.

From paying staff wages, social security benefits, and loans to collecting payments from customers, MSMEs found themselves in serious financial distress. As such, they could not maintain a good cash flow in their day-to-day business activities.

MSMEs who needed financial support to cope with COVID-19’s impact on their business explored different funding options. This strategy has allowed them to carry out their business recovery plans slowly.

COVID-19 has taught us valuable life lessons, including managing finances amid a crisis—in the context of the Philippine economy, that means getting MSMEs involved in reviving the country’s favorable business conditions.

Thus, restarting the economy requires the recovery of our micro, small, and medium enterprises. Now that the pandemic is slowing down, it’s the perfect time for MSMEs to reopen their doors and begin their journey toward business recovery.

Fortunately, small business loans are accessible now more than ever. JK Capital offers zero-collateral, low-interest business loans to boost your finances and help your company get back on track. Inquire about our easy business loan!

Every entrepreneur’s journey starts with finding ways...

Signs reading, "Sorry we are temporarily closed," were ...